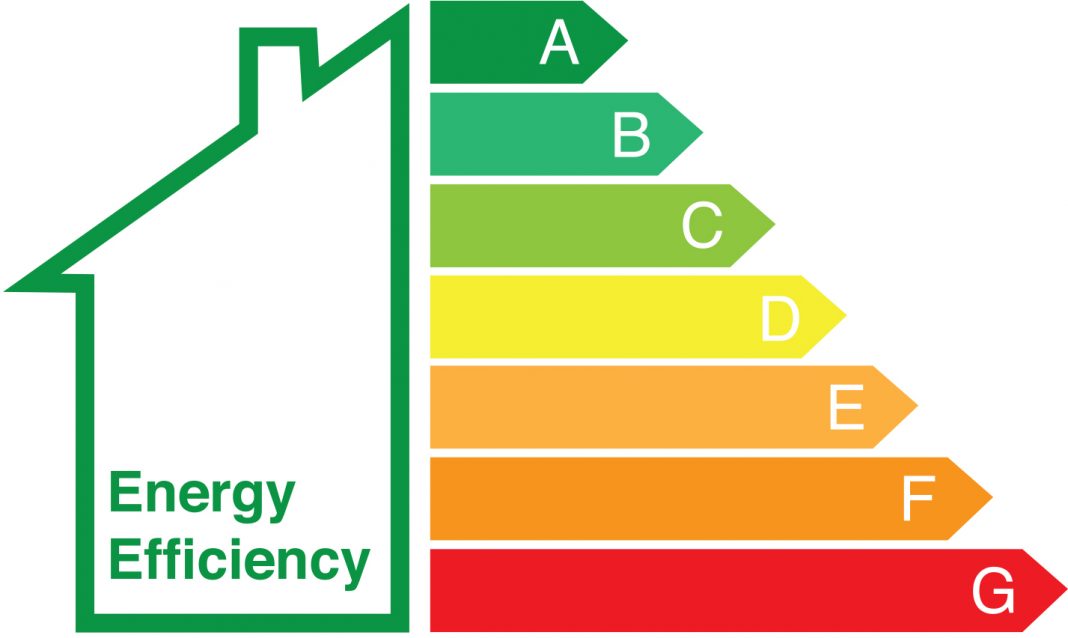

Propertymark has analysed data from the latest English Housing Survey and is warning the market that 40% of the English PRS are likely to fall short of EPC rating targets currently proposed to come into force later this decade.

Demand has kept pace throughout the year irrespective of market conditions.

The Bank of England has been increasingly raising its base interest rate since the start of the year in an effort to curb rising inflation.

The number of buy-to-let portfolios changing hands has surged sixfold as Britain’s largest landlords race to escape the Government’s tax crackdown, research shows.

Rightmove’s data analysis reveals how much they have risen.

A quarter of homebuyers are putting off their purchase due to cost of living fears – and when it comes to first time buyers, the proportion is even greater.

Air travel has reduced in demand since before the pandemic by as much as 76%, a sign that staycations are still very much on the cards for Brits this year, thus making it an excellent time to be an Airbnb host in the UK.

- House Prices Continue To Rise, Say Rics Estate Agents - Even Though Demand From Buyers is Faltering Amid Interest Rate Hikes

- Property Market Faces Rising Profile of Energy Ratings on Homes

- UK Launches Register of Overseas Property Owners

- Average House in England Now Costs Nearly NINE Times The Average Salary

- Cheapest Places To Rent a Room In The UK As Prices Continue To Rocket

- Rightmove Reveals The Latest Uk House Prices

- Surprising Momentum’ In Housing Market As Prices Increase By 11% Annually

- Banks & Building Societies To Stop Mortgage Stress-tests